Level 5 (subscribers) – Automotive

(From Challenger to Leader)

The ranking of the best players and the scores to beat, right here:

In this new automotive session, you are at the helm of Latesun, the American leader in electric vehicles. In the previous session (Stay a Leader), you were the cat, now you will be the mouse, but a mouse with a chance!

As in the previous game session (Stay a Leader), don’t forget the lessons from Chapter 4, especially those on segmentation in the automotive sector and substitutions! Also, carefully review Chapter 7 (Succeeding When You Are Smaller). Remember the case of Bénéteau!

From Challenger to Leader – Board of Directors of Latesun (companies and fictional data)

![]()

Economic Context

The global market for combustion engine vehicles is still growing, but the market for electric vehicles is growing faster by substituting them. We hypothesize that in 25 years, electric vehicles could represent more than 50% of the market. You can therefore hope to become the world leader in all segments one day!

The world is not the one of today (we are in an imaginary world).

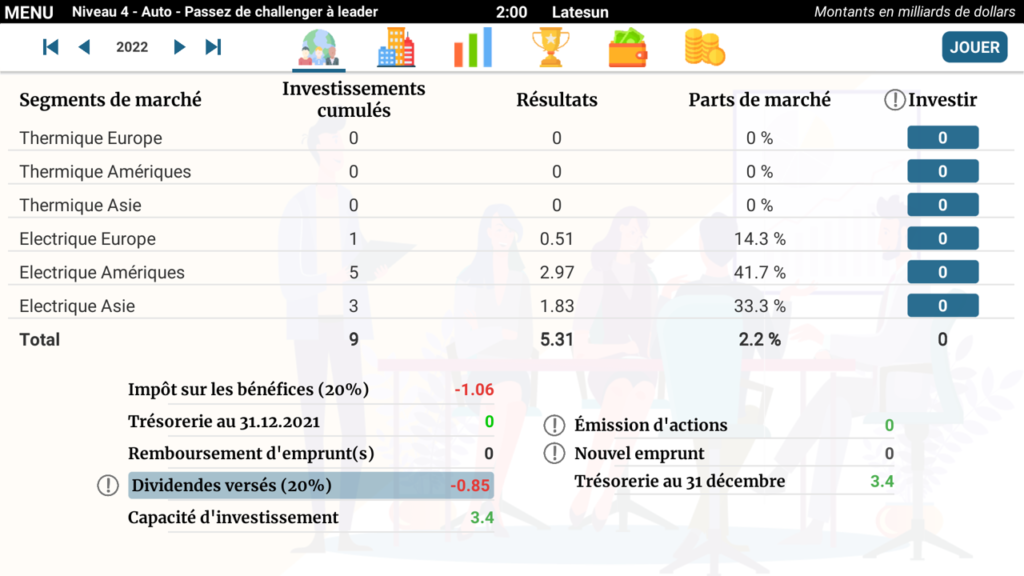

![]()

The Competitive Situation at the Start of the Game

The game is played in six segments:

- Combustion engine vehicles in Europe, Asia, and the Americas

- Electric (or hybrid) vehicles in Europe, Asia, and the Americas

Your company, Latesun, a pioneer in electric vehicles, has become the world leader in a few years. You have no production issues and have successfully formed an alliance in China, giving you a good market share in Asia as well.

When you take over, Latesun is not the global leader among all car manufacturers because it is only present in the electric vehicle market segment and not in the combustion engine vehicle market segment, which is currently the largest segment.

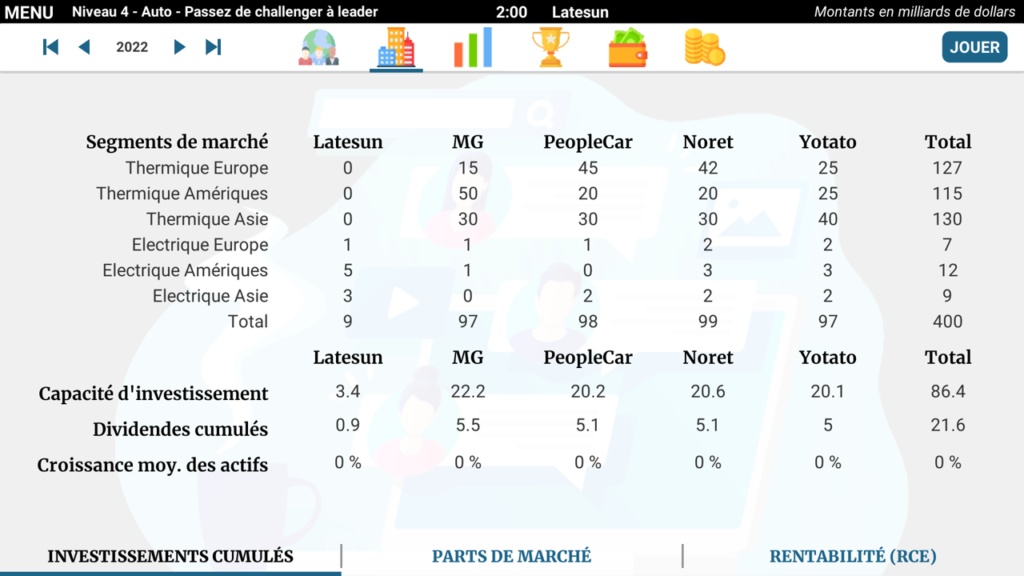

From Challenger to Leader – Initial Assets of the Five Competitors (companies and fictional data)

Your company is, however, pursued by 4 traditional competitors who are weaker than you in electric vehicles but have solid cash cows in combustion markets, giving them resources to catch up with you.

![]()

Main Game Parameters

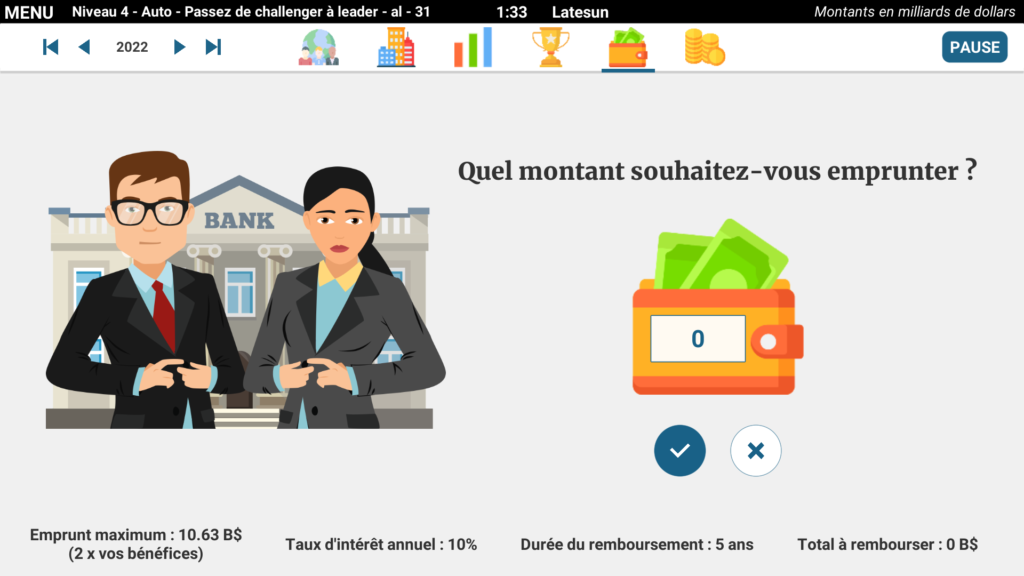

You can, of course, use the leverage of debt, like your competitors, but the world has changed: interest rates have risen, making debt more expensive than a few years ago and bankers stricter. At the same time, customs barriers have been created, and the “product” landscapes have taken on a significant geographical dimension.

![]()

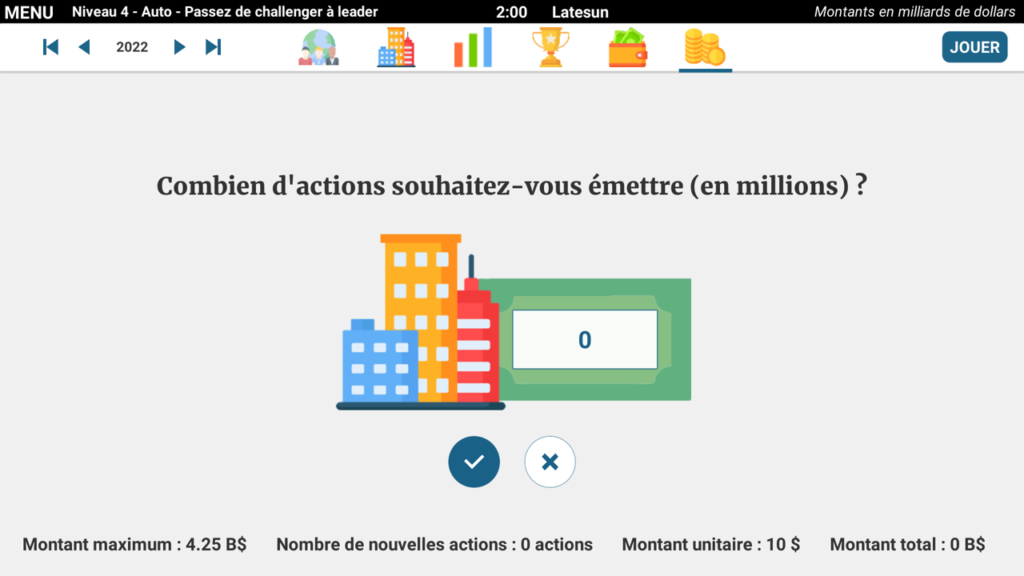

Finally, you have an asset that your competitors do not have (in the game): the ability to issue shares because you are a “pure player” leader in your field, with a readable strategy, which the stock market appreciates.

Increasing your capital by issuing new shares is, however, a double-edged sword. Issuing shares does indeed bring liquidity into your company, boosting your investment capabilities, but it dilutes your profits and therefore your dividends per share, if you pay them.

If your profits do not grow quickly, this can even lower the unit price of your shares, which in the game is calculated according to the formula: profit x PER / number of shares. So you must invest wisely so that this cash influx produces enough profit!

These two points are important in real life but also in the game, as your score is calculated by adding the unit price of your shares and the annual average dividends you have paid to your shareholders for each share since the first year of the game!

![]()

Good Luck!

.

To start a new game:

. If you are on a computer: Click here

. If you are on a smartphone or tablet, download the “Strathena” mobile app on Google Play or the App Store.