Game’s rules

Game’s rules

You lead the board of directors of a company that has invested in several product lines or in several territories and make the main annual strategic decisions that commit the evolution of the company in the medium and long term.

Your company is in competition with other companies that have also invested in products or territories that compete with yours.

The goal of the game is to develop your company as best as possible, while respecting regulations, avoiding the many risks that threaten your company and maximizing the value of your company from the point of view of your shareholders.

In the game, your competitors are managed in real time by artificial intelligences that examine competitive positions and adapt their strategies like you year after year.

Strathena – Board of Directors

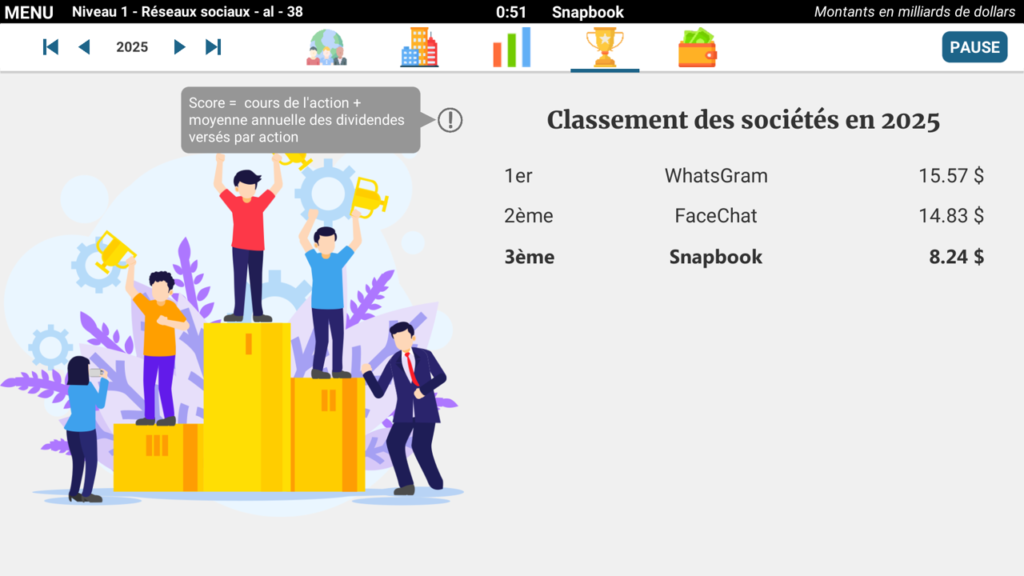

Your Score

Your score in the game is calculated year after year and represents the evaluation of your decisions, from the point of view of your shareholders. It is calculated by totaling:

- The unit price of your shares

- The annual average of dividends that you have paid to your shareholders for each share since the first year of the game.

Strathena – score chart

Year after year, you can follow your ranking compared to your virtual competitors on the graph above or in the “Ranking” tab:

Strathena – Competitor Ranking

![]()

Note: This scoring formula has been in effect since October 31, 2020. If you are playing on the Android or iOS app and downloaded the app before this date, don’t forget to update it to play with this new formula.

Please note that the unit value of your shares is equal to the value of your company divided by the number of shares.

The value of your company is equal to the PER (Price Earning Ratio) x your profits. For the sake of simplification, your PER is generally set at 10 or 15 in the game.

Until October 30, 2020, the score was calculated differently, by totaling:

-

- The value of your company, equal to 15 times your profits.

- The cumulative dividends that you have paid to your shareholders since the first year of the game.

- Your cash flow at the end of the year

- Your level of debt, which reduces your score.

![]()

Your Decisions

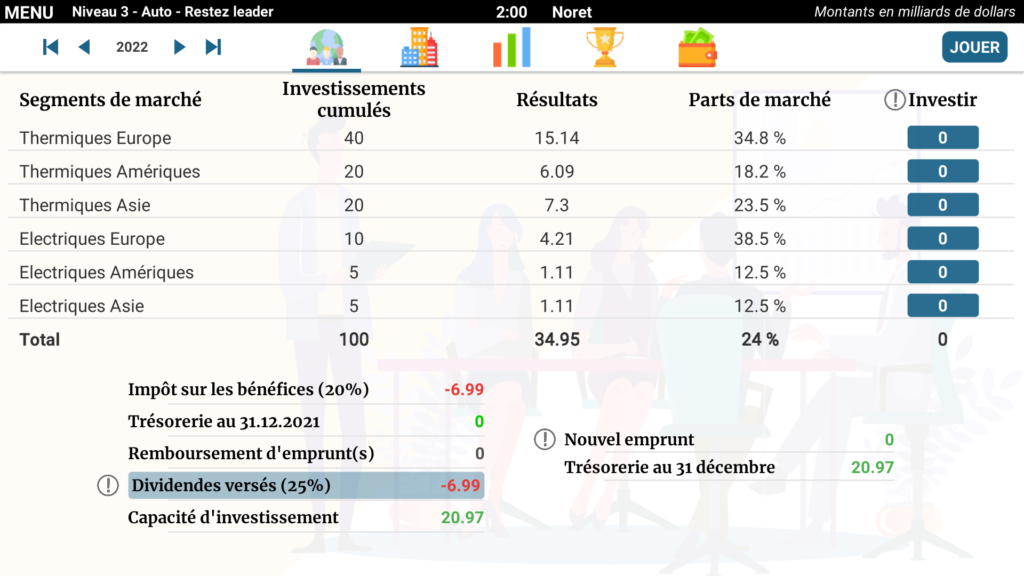

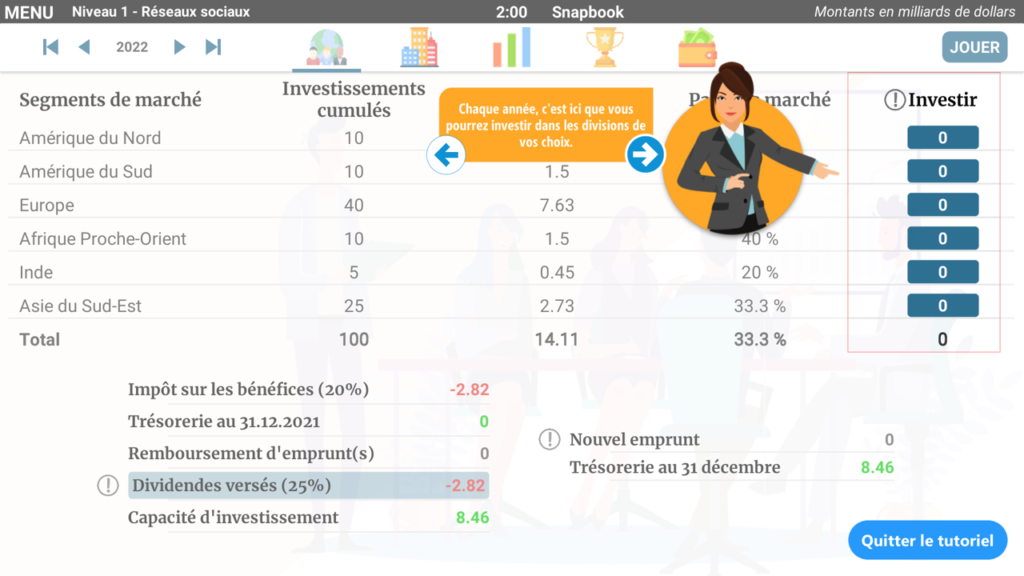

Your first decision is to reinvest your profits in your different divisions (products or territories). By investing, you will change the competitive landscape. Competitors who change it to their advantage will gain the upper hand in the game.

You can distribute your investment capacity in different ways:

-

- in a uniform way across all your divisions.

- by investing more in low-profitability divisions to strengthen them.

- by investing instead in high-profitability divisions to capitalize on your strengths;

- you can also disinvest by selling the assets of your least profitable divisions or those present in weak markets and using the cash generated by these sales to invest in other divisions more promising.

Strathena – investment decisions

You can increase your investment capacity in several ways:

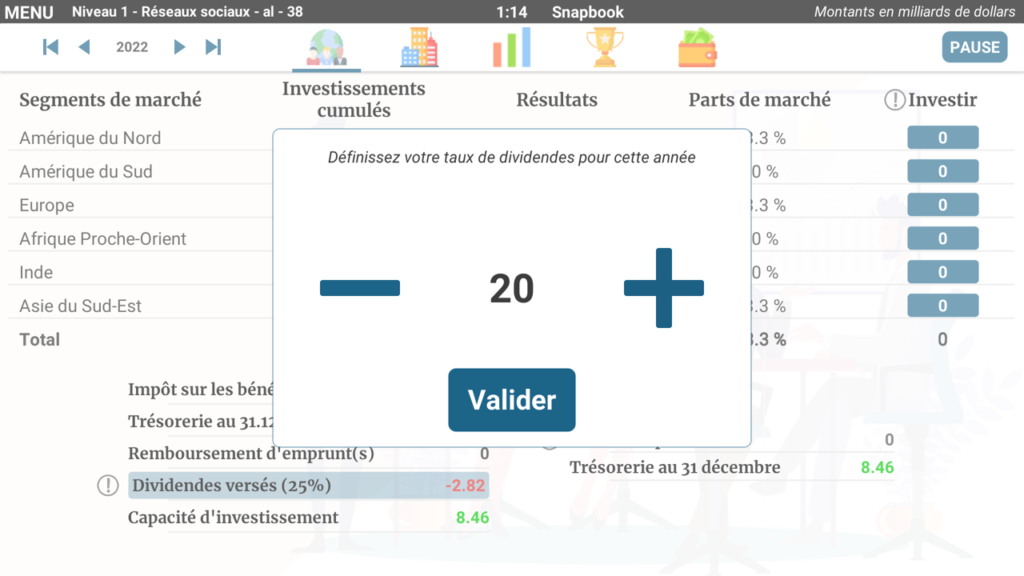

- by lowering the dividend rate to be paid to your shareholders:

Strathena – choice of dividend rate

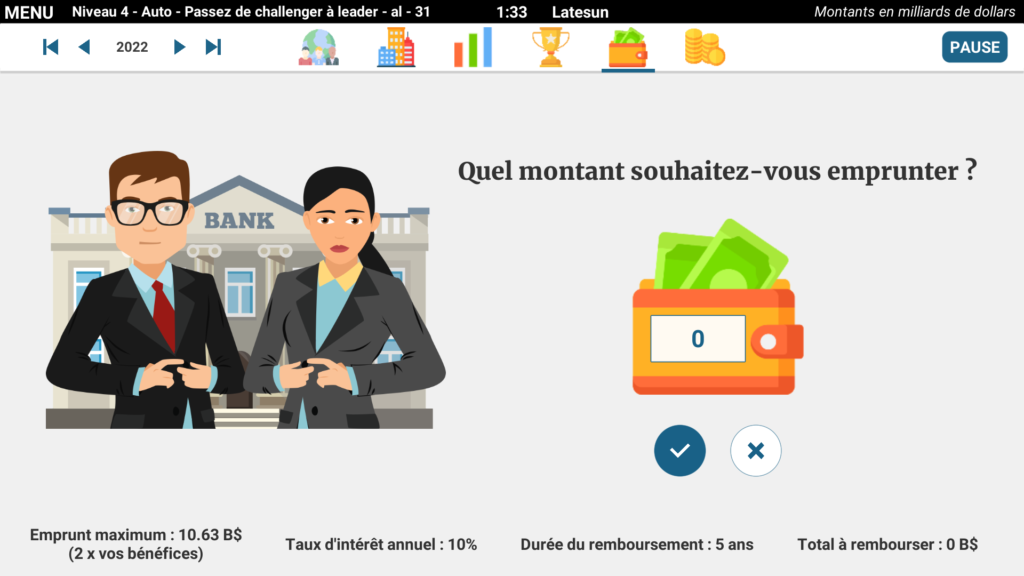

- by taking out a loan that will help you increase your investments.

- Your banker will inform you of the maximum amount that can be borrowed, the interest rate in effect and the repayment period.

- Before confirming your loan application, he will inform you of the total amount to be repaid.

- From the following year, you will have the borrowed funds and will begin to repay the capital and interest.

- Your repayment instalments will be automatically deducted from your cash flow.

- You will only be able to take out a new loan after you have repaid your loan in full.

Strathena – new loan

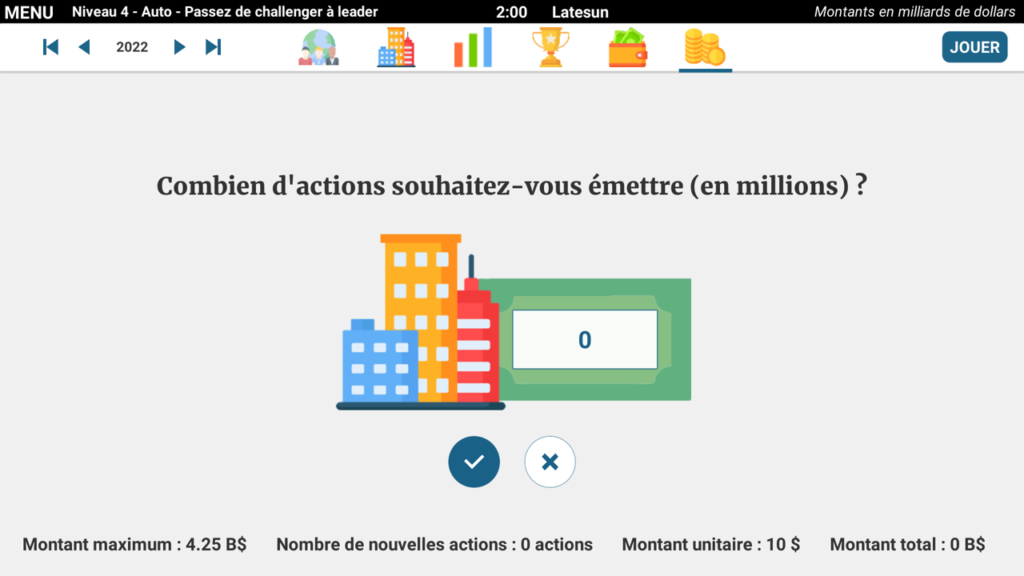

- by issuing new shares (in advanced sessions):

- A share issue allows you to bring new money into your company, which allows you to invest more massively, thus potentially increasing your profits if you invest wisely.

- Conversely, before your investments produce their effect, your share issue may in the short term mechanically lower the unit price of your shares since it is in the game equal to the value of your company divided by the number of shares (which has just increased).</ li>

- If you pay dividends for the same amount as before this issue, the yield on your shares (the amount paid per share) will therefore also fall.

- Your score in the game being equal to the current price of your shares added to the average dividends per share paid since the start of the game, it It is therefore possible that it will temporarily drop before your investments bear fruit.

Strathena – share issue

Time flies on Strathena! You will have to register your decision before the end of each virtual year, which will only last a few minutes for you; the server will then calculate the results of each competitor and the new market shares and will communicate them to you a few seconds later.

![]()

Market regulation

Your decisions are supervised by a central banker who regulates the economy:

. in the banking sector (level of interest rates, loan repayment period, maximum debt ratio)

. and in the stock market (by setting a maximum dilution rate for your share issues).

It also guarantees market balance by prohibiting dominant competitive positions (antitrust rule).

Strathena – limitation of dominant positions

![]()

The risk of cessation of payment

Be careful, in addition to the central banker, your company’s banker is also keeping an eye on you! He will grant you an overdraft authorization which will be communicated to you at the beginning of the game. If your cash deficit exceeds this authorized limit, your banker will block your accounts and your company will be declared insolvent, which will immediately lead you to bankruptcy (game over! 🙁 ).

Note: in games played up to July 10, 2020, it was exceeding a loss / total assets ratio that led to bankruptcy. The modification of this parameter aims to get closer to the reality of companies whose survival depends above all on their cash flow.

.

![]()

Advanced Levels

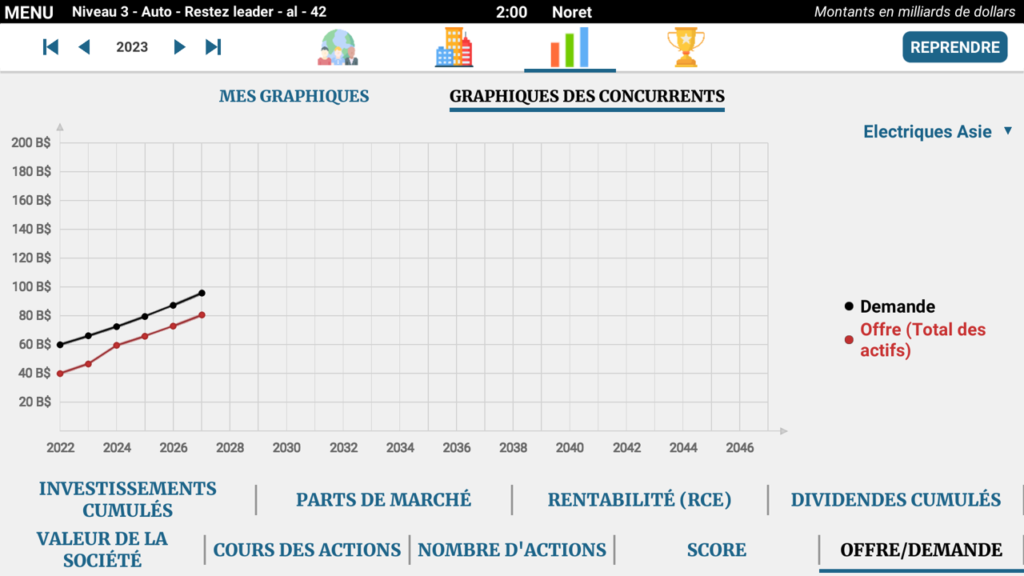

The game’s advanced levels (reserved for subscribers) allow you to follow the evolution of life cycles and the supply/demand ratio in each of your divisions.

You will need to pay attention to:

- the risks associated with overcapacity that crushes prices and profitability (markets in which supply exceeds demand),

- and the opportunities that, conversely, represent markets in which demand exceeds supply.

A new graph will show you the annual supply/demand ratio in each region (tab “Competitors Graph”).

Strathena – supply / demand ratio

.

![]()

Multiplayer mode

Multiplayer mode is offered to training organizations, educational establishments and businesses. It allows a trainer to lead a strategy course by having players play against each other.

Each player drives the strategy of a company in competition with those managed by the other players. In particular, it is possible in this mode to practice external growth strategies:

- By auctioning off its least profitable divisions,

- By purchasing divisions put up for sale by its competitors.

Learn more about multiplayer mode.

Strathena – external growth (auction history)

.

![]()

It’s your turn to play now!

Click here for a presentation of all game sessions.

Oh, one last thing! 😉 You will find a summary of this game rule as well as a tutorial presenting the main screens in the side menu (see below):

Strathena – side menu

Strathena – tutorial

![]()