BFM Strategy Game – Summer 2024

(Becoming a leader in the energy transition)

The challenge is over but the three sessions remain accessible to subscribers.

Congratulations to the three winners!

1st: Benjamin Sapin

2nd: Matthieu Ostertag

3rd: Eric Tadbir

They were invited by BFM Business to present their strategy as part of the BFM Stratégie program broadcast on November 23, 2024.

Click on the image to watch the program!

![]()

BFM Strategy Game – Summer 2024

(Become a leader in the energy transition)

Following the success of the BFM/Strathena challenges in 2018, 2019, and 2020, Strathena had once again partnered with the BFM Strategy show to offer a game-contest in July and August 2024 with the promise to invite the best players to the BFM Strategy show.

The BFM / Strathena 2024 challenge was presented on BFM Business during the BFM Strategy show on Saturday, June 29, 2024:

The game consists of three sessions on the topic of energy producers and the energy transition. The first session was made available on July 1st on the website strathena.fr.

The players had free access to these three sessions, which are now reserved for subscribers.

![]()

Presentation of the BFM 2024 game

Your mission

You will have three boards in your hands that will allow you to reflect on the competitive and financial issues of the energy transition in Europe. The objective of the game is primarily educational and is not intended to faithfully or exhaustively represent the European competitive reality.

It involves eight major players in the energy production and distribution industry: three oil companies, two mining groups, and three electricity producers.

You will successively lead three groups:

Session 1 (July): a major international oil group

Session 2 (August): a group specializing in mining

Session 3 (September): a major electricity producer, leader in the nuclear sector.

As in all other Strathena sessions, your company will initially have a portfolio of strategic positions allowing it to play a decisive role. Your responsibility will be to manage your company’s investments and financial policy in this complex environment. Your competitors will be driven by artificial intelligence reacting to your choices.

You will see that the future is far from being written and depends greatly on the quality of the decisions that will be made. You will also get an idea of the competitive economy’s ability to meet the energy transition challenge and the financial policies that allow it to be financed.

![]()

The economic context

This board starts in 2024 and represents the competitive positions of the largest European energy producers. It includes the growth of new forms of energy and the importance of the mines of metals necessary for electric batteries.

After being dominated for decades by large oil groups and national monopoly electricity producers, the energy market is on the brink of a revolution.

The increasing adoption of greenhouse gas taxation measures and ecological incentives is pushing European producers to replace hydrocarbon-based energy with decarbonized electric energy from nuclear power plants and new forms of energy (solar, wind, geothermal, biomass…).

If traditional players disinvest intelligently, this energy transition will allow them to generate significant net cash flows that will be invested in growing niches. However, competition in these sectors will be intense and will require making choices.

![]()

The competitive context

In the game, prices are market prices established by the competitive system, without state intervention.

There are countless players in the energy market, but for simplicity, we have retained only the largest actors in the competitive board:

- The large oil groups that are now also investing in new energies, alongside pure players.

- The mining groups that still extract large quantities of coal today but are beginning to invest in nickel, lithium, and cobalt mines essential for electric vehicle batteries, whose needs are exploding. The large oil groups are also investing in this niche.

- The electricity producers, some of which still operate coal or gas power plants and will be formidable players with great opportunities.

The transition will therefore take place in the context of intense competition on two levels: competition between industries and competition within each industry.

![]()

Energy market perspectives

In the game, the evolution of total energy demand is based on studies by a large oil group that distinguishes three scenarios:

- The first is the continuation of the current trend in oil and gas product consumption.

- The second is a disruptive scenario that relies on a global decrease in consumption thanks to massive investments in building insulation, industrial energy savings, and a rapid transition to electric vehicles.

- Between the two, a scenario called “momentum,” in which global energy consumption growth is moderate. This is the scenario adopted in the game.

The assumption here is that energy renovation efforts will bear fruit and that the conversion of vehicles to electric propulsion will continue. In other words, there will be a substitution between different types of energy. Half of the markets will experience a decline, while the other half will see sustained growth.

As in any competitive market, each actor’s profit levels are determined by:

- their relative market shares</span >, niche by niche

- and by the supply/demand ratio, which can generate overcapacity or undercapacity.

![]()

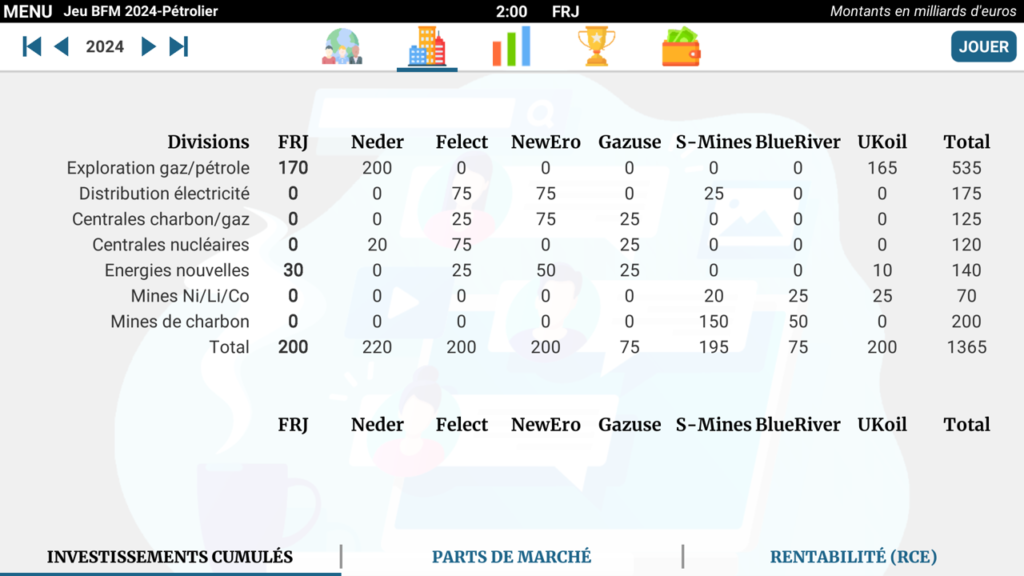

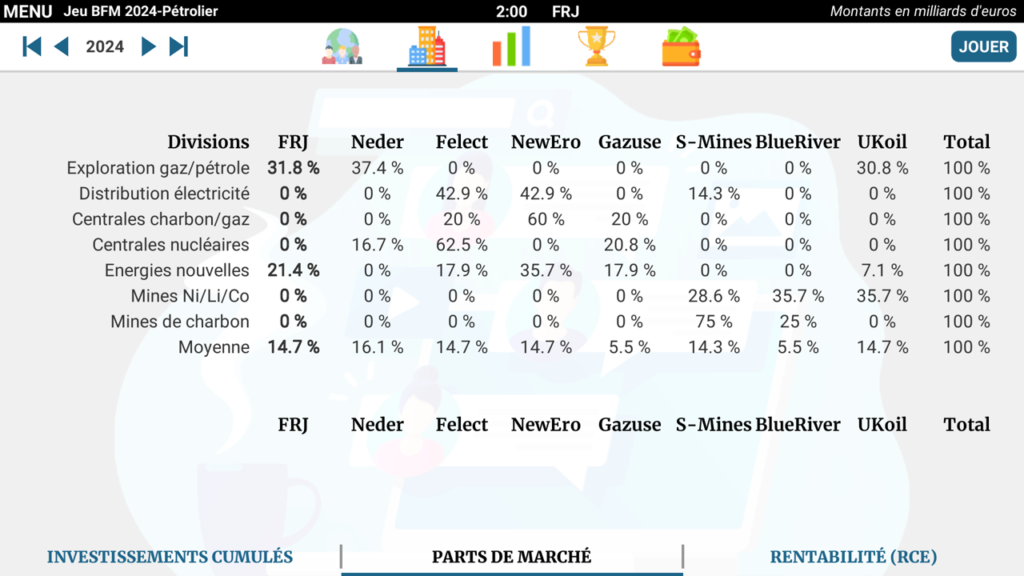

The competitive situation at the start of the game

Each of the three sessions of the energy market includes 7 niches and 8 players:

- oil and gas extraction, a niche dominated by three European leaders.

- electricity distribution, a market held by integrated producers operating nuclear, coal, or gas power plants.

- coal and gas power plant operation, dominated by two historical actors.

- nuclear power plant operation, a niche dominated by a European expert followed by two more diversified groups.

- new forms of energy (solar, wind, geothermal, biomass…) grouped into a single niche for simplification, in which five actors have started investing.

- metal mines necessary for electric batteries (Nickel, Lithium, Cobalt). This niche is dominated by two “pure players” but is also invested in by an oil group.

- coal mines. The two pure players in the mines are also present in this declining niche.

The relative size of the niches and their growth rates are approximately those found in available financial reports.

Market shares of the eight competitors

(fictional companies and data)

![]()

The main parameters of the game:

In the game, you can use debt leverage, like your competitors.

You must be careful to always stay liquid. If, for example, you incur too much debt and go through several years of loss, you could very well go bankrupt. Be careful to dose your efforts wisely!

Your score is calculated according to the formula: unit share price + annual average dividends per share paid since the first year of the game.

The unit share price is calculated according to the formula: profit x PER / number of shares. It is up to you to invest wisely so that this cash flow generates sufficient profits!

![]()

Good luck to all!

.

To start a new game:

. If you are on a computer: Click here

. If you are on a smartphone or tablet, download the “Strathena” mobile app from Google Play or the App Store.