Level 6 (subscribers) – Automobile (Mastering Substitution)

Created in 2018, the first two chessboards in the automotive sector (Stay Leader and Go from Challenger to Leader) proved to be predictive, as they anticipated the rise of Tesla.

In the summer of 2018, they were the subject of a nationwide competition in France. We brought the three winners to the set of the show BFM Strategy, where they brilliantly explained their respective strategies. Watch the show, it will probably inspire you for your next games!

Economic Context:

This third automotive chessboard starts in 2024. It includes the rise of the charging station market and assumes the development of the hydrogen vehicle market.

After a spectacular breakthrough in the rapidly growing electric vehicle market, Latesun is now challenged by traditional car manufacturers who have gradually entered the electric market while keeping a foothold in thermal engine vehicles to support its decline in countries planning its disappearance.

Chinese manufacturers are also entering the electric market strongly, favored by the strong growth of a gigantic domestic market.

As with the previous two game sessions on the automotive industry (“Stay Leader” and “Go from Challenger to Leader”), do not forget the lessons from Chapter 4, especially the one on segmentation in the automotive sector and the one on substitutions.

![]()

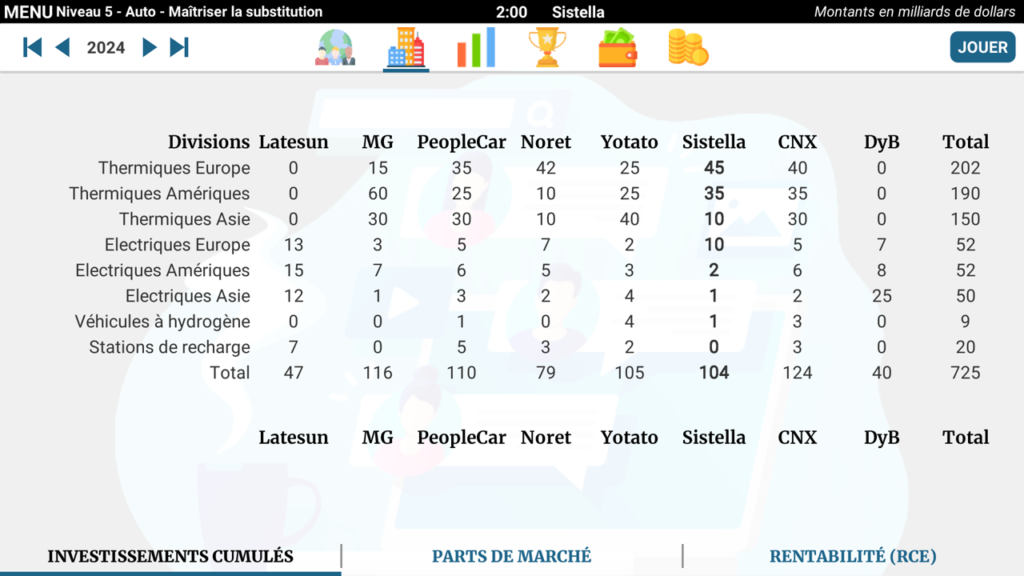

Competitive Situation at the Start of the Game:

This new competitive chessboard includes eight competitors and eight slots:

- 3 geographical slots for thermal engine vehicles: Europe, Asia, and the American continent

- 3 geographical slots for electric (or hybrid) vehicles: Europe, Asia, and the American continent

- The emerging slot for hydrogen vehicles

- The slot for charging stations, essential for the growth of electric and hydrogen markets, which several of your competitors have started to occupy.

Mastering Substitution – initial assets of the eight competitors

(fictional companies and data)

![]()

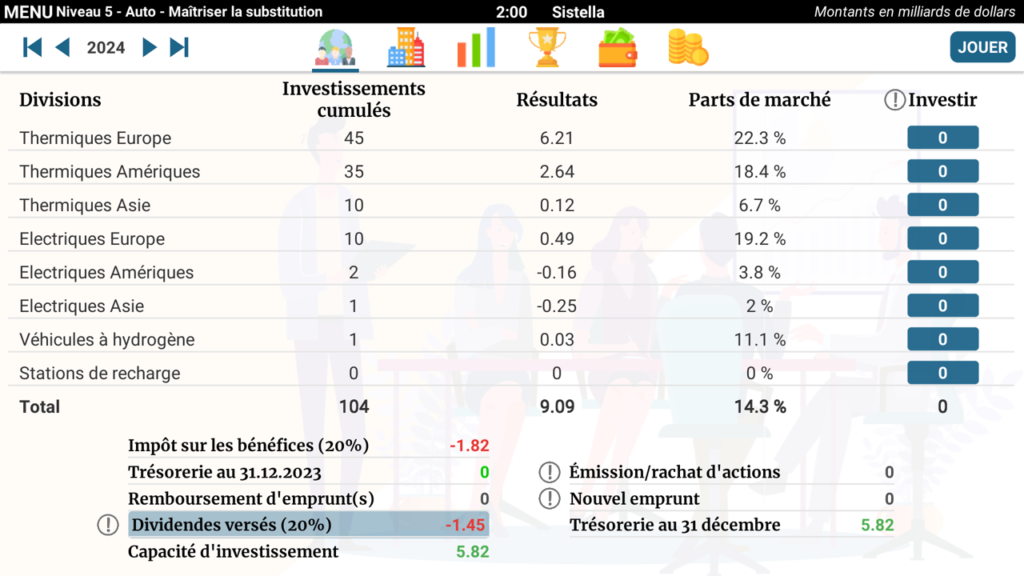

Your Company:

In this third automotive session, you will lead Sistella, a traditional manufacturer among the European leaders in thermal vehicles.

Sistella has recently invested in the production of electric vehicles. However, the thermal engine vehicle slot remains your cash cow, providing the financial resources to catch up in the new market segments.

Will you make the right choices while resisting pressure from all sides?

Mastering Substitution – board of directors of Sistella

(fictional companies and data)

![]()

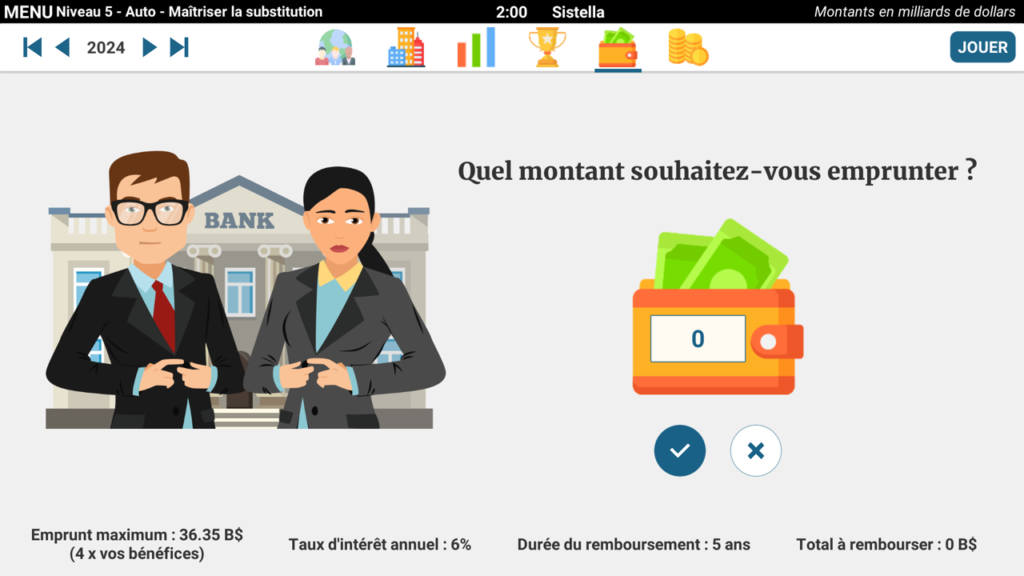

Main Game Parameters:

You will play over 20 virtual years. Each year in the game lasts two minutes, so a game lasts 40 minutes.

You can use the leverage of debt, like your competitors, but interest rates are high, making debt more expensive than a few years ago, and bankers stricter.

![]()

As in the previous session, you have an asset that your competitors do not (in the game): the ability to issue shares.

Increasing your capital by issuing new shares has a double edge.

A share issue allows you to bring fresh money into your company, enabling you to invest more massively and potentially increase your profits in the medium term if you invest wisely.

However, before your investments take effect, a share issue will mechanically lower the unit price of your shares and their yield since it is calculated according to the formula: profit x PER / number of shares (which has just increased).

Mastering Substitution – stock prices of the eight competitors

(fictional companies and data)

This share issue dilutes your profits into a larger number of shares, so the dividend yield (amount of dividends you pay per share) will also mechanically decrease in the year of your capital increase.

This is also the case for your score (= unit price of your shares + annual average of dividends you have paid to your shareholders per share since the first year of the game).

If your profits do not grow quickly, it can even permanently lower the unit price of your shares and thus your score. Therefore, be careful to invest wisely so that this cash inflow produces enough profits!

![]()

That’s not all! In addition to the ability to issue shares to finance your growth, you can, in this new game session, buy back your own shares if you happen to have excess cash that you do not wish to reinvest. Be sure to watch the course video on share buybacks to understand its importance in certain situations.

![]()

Good Luck!

.

To start a new game:

. If you are on a computer: Click here

. If you are on a smartphone or tablet, download the “Strathena” mobile app on Google Play or the App Store.